This is the fourth part of my blog on neoliberalism. It goes back further in time (a few centuries in fact) to trace the origins and revival of neoclassical economics. I ask the following questions:

- What is neoliberalism?

- Where did it come from?

- What explains its ascendancy in the 1980s?

- And its decline in the 2010s?

The star-studded cast of this blog includes Adam Smith, Karl Marx, Jeremy Bentham, Alfred Marshall, Friedrich Hayek, John Maynard Keynes, and Milton Friedman.

Here’s the rap version: Keynes Vs Hayek rap (just kidding, but hey this is good!), and a two minute slideshow version from Robert Skidelsky.

What is neoliberalism?

To grasp the meaning of neoliberalism, we turn to its origins, not in the polemics of Reagan and Thatcher, but in the liberal philosophy and neoclassical economic theory of the 18th and 19th centuries: the age of enlightenment.

To distinguish between the neoclassical school of economics and its underpinning ideology, we use ‘neoliberalism’ as a label of convenience for the latter. While the word has many meanings, this is apt, considering the roots of neoclassical economics in philosophical liberalism, and its close association with political liberalism.

Science and ideology

Along with all scientific thought, economics has competing ideological underpinnings. This is not to suggest that science can be reduced to ideological principles. Science understands the world through a process of theoretical development, hypothesis testing and experiment.

Rather, each school of scientific thought is underpinned by a set of beliefs about how the world works and these are in turn shaped by the society of the day. For example, the notion that different races represent different stages of human development is an ideological one, yet it was the foundational principle of social darwinism, a school of sociology in the late 19th century, that was influential at a time when the western powers were growing their African and Asian colonies.

The meaning of neoliberalism changed over time. An early iteration in the first half of the 20th century drew a distinction between the ‘laissez faire’ approach of 19th century neoclassical economics and a ‘new’ economic liberalism offering a middle course between neoclassical positions and socialism. In the latter half of the 20th century, this was reversed: neoliberalism was associated with the Mont Pelerin Society’s more strident advocacy of neoclassical positions (the meaning adopted in this blog), and the rejection of collective solutions to economic and social problems.

From liberal philosophy to neoclassical economics

Neoclassical economics was associated in its early years (the 1870s and 80s) with Jevons (in its English variant), Walras (the Swiss variant ), and Menger (the Austrian variant). It was synthesised by Alfred Marshall in the late 1800s. Marshall re-worked the classical political economy of Smith and Ricardo (on which more later) to develop many of the concepts and tools used by today’s economists, including supply and demand, and the use of mathematical models.

Neoclassical economics was underpinned by the liberal philosophy of the time. As its key organising principle, it borrowed from Jeremy Bentham the idea that human welfare can be measured as the utility (pleasure over pain) of the greatest number of individuals (the greatest good for the greatest number):

‘By the principle of utility is meant that principle which approves or disapproves of every action whatsoever, according to the tendency which it appears to have to augment or diminish the happiness of the party whose interest is in question: or, what is the same thing in other words, to promote or to oppose that happiness.’ Bentham J (1838), Introduction to the Principles of Morals and Legislation

As with Margaret Thatcher one and a half centuries later, Bentham’s philosophy privileged the individual over constructs of ‘society’. For him, the idea of relations among people was a ‘fictitious entity,’ necessary for ‘convenience of discourse.’ Hence, ‘the community is a fictitious body,’ and it is but ‘the sum of the interests of the several members who compose it.’ Bentham J (1824), The Book of Fallacies.

This was a radical idea, contrary to the prevailing conservative idea that individuals only mattered for the role they played in the social order. The individualism of liberal philosophy was associated with the emergence of ‘civil society’ – a place where people interacted not as lords, knights and serfs bound by feudal ties, but as individuals free to exchange with others in the marketplace and exercise their political rights as citizens (if they were men and held enough property!). ‘Divine right’ was replaced by ‘social contract’. Some enlightenment thinkers, such as Rousseau, heralded a new egalitarian society. Others, including Bentham, celebrated the new-found rights of the individual. This divide in enlightenment thinking is discussed further in the next blog.

From Divine Right to Social Contract

The civil society of the enlightenment was not the same as the modern version (non-government organisations acting outside the market). Rather, it encompassed both political and market relations among free citizens. It was both a creature of early capitalism and a condition for its expansion. Along with Opera, the ‘free market’ and the vote for men of property were championed by the ascendant capitalists (and their political party in Britain, the Whigs), against political resistance from the land-owning class (and its political representative, the Tory Party).

Bentham was politically active and close to the Whig leaders. He was a strong advocate of the ‘New Poor Law’ of the 1840s that denied cash benefits to able-bodied people and required them instead to labour in workhouses (discussed in my blog on Basic Income), as well as a new design for prisons (the ‘panopticon’) that enabled guards to supervise prisoners more efficiently. The ‘protestant work ethic’ resolved the tension between these policies and the liberal principle of individual freedom. Since individuals were free to sell their labour, poverty was a personal failing best resolved by providing the strongest incentives to work.

Jeremy Bentham lives on, in the utility cupboard

Bentham asked that his body be dissected preserved and put on display in the interest of science, and to be wheeled out at parties. It sits in a cupboard at University College, London.

A key innovation of neoclassical economics (underpinning its claim to scientific status) was the application of mathematical modelling to test the circumstances in which utility was maximised. Neoclassical economic models assumed that this happy state of equilibrium between supply and demand could be reached, provided markets were unconstrained by excessive State intervention or anti-competitive practices (such as monopolies or the intervention of unions to bid up wages).

As the discipline evolved and real-world conditions were acknowledged, exceptions to this rule were allowed, such as ‘market failure’, ‘transaction costs’ and other ‘rigidities’, but the inherent efficiency of ‘free’ markets was the starting point.

The base-line assumption of neoclassical economics – that ‘the economy’ is a product of the interaction of rational individuals with perfect information – is a remarkably one-dimensional view of the way economies and societies function. Focussing on exchange among individuals through markets, it bypassed theories of society and reduced ethics to the pursuit of happiness. A new science of society – sociology – emerged at the same time to explain the transition from traditional to civil society, but the two disciplines for the most part took separate paths.

Neoclassical economics was ahistorical. Influenced as they were by the social darwinism of Spencer, the early neoclassical economists contrasted economies governed by a free market with those of ‘primitive’ society, but showed little understanding of the particular historical conditions under which civil society emerged in the West in the 18th and 19th centuries. For the early neoclassical economists, civil society and the ‘free market’ in effect represented the ‘end of history’, an argument reprised by Fukuyama in 1989.

Differences between neoclassical and classical economics

The idealisation of the ‘free market’ by neoclassical economists recalls Adam Smith’s ‘invisible hand’. However, Smith and his fellow classical political economists of the 18th and 19th century had a deeper understanding of the relationship between economy and society. Smith’s ‘Wealth of Nations’ was accompanied by his ‘Theory of Moral Sentiments’ which explored interactions among individuals in the emerging civil society. In Smith’s view, there was room for doubt as to whether market competition was socially beneficial.

For Smith and two other prominent classical political economists, Ricardo and Marx, the value of a product was determined, not by supply and demand in the process of exchange, but by the labour embodied within it in the production process. Part of that value (the ‘surplus’) was expropriated as profits by capitalists and reinvested, facilitating economic expansion. In these classical theories of value, there was room for social groups and institutions to shape markets through their contest over the distribution of the surplus.

Marx’s contribution was to name the ‘elephant in the room’ of classical political economy: the extreme disparities of economic resources and power which 19th century scholars and politicians called the ‘social question’. In place of ‘individuals’ and ‘society’, his unit of analysis was ‘social classes’, defined by their relations in the production process. In this way, economics and sociology were drawn together.

The working class provided the labour power that was the source of economic value; the capitalists owned and controlled the means of production and extracted surplus value from their labour; while the landowners extracted rents from their ownership of land. Thus, individuals did not enter into exchange on an equal footing.

For marxists, social classes fought over their respective shares of the surplus as successive ‘modes of production’ (such as feudalism and capitalism) emerged, matured and collapsed. Those tensions were ultimately resolved by social revolutions in which one mode of production gave way to the next, and control of economic production and the State passed from one dominant class to the next. Capitalists supplanted landowners in bourgeois revolutions (of which the French revolution was one) and the working class would supplant the capitalists in socialist revolutions (the goal of the Bolshevik revolution in Russia a century and a half later).

To summarise, the underlying assumptions of neoclassical economics – that markets are shaped by transactions among individuals rather than social groups or institutions, that economic growth is desirable in its own right, and that ‘interference’ in the free operation of markets is (on the face of it) inefficient – have ideological roots in an individualistic variant of enlightenment philosophy.

From neoclassical to keynesian economics

The core principles of neoclassical economics guided economic policy in the West (especially in the Anglosphere) during the ‘laissez faire’ or ‘gilded age’ of the late 19th century: free trade, ‘sound money’ (based on convertability of currencies to gold, not the meddling of politicians or government-controlled central banks), and minimal government interference in markets, including the labour market.

It was called the gilded age for a reason..

Newport Golf Club (New York, late 1800s)

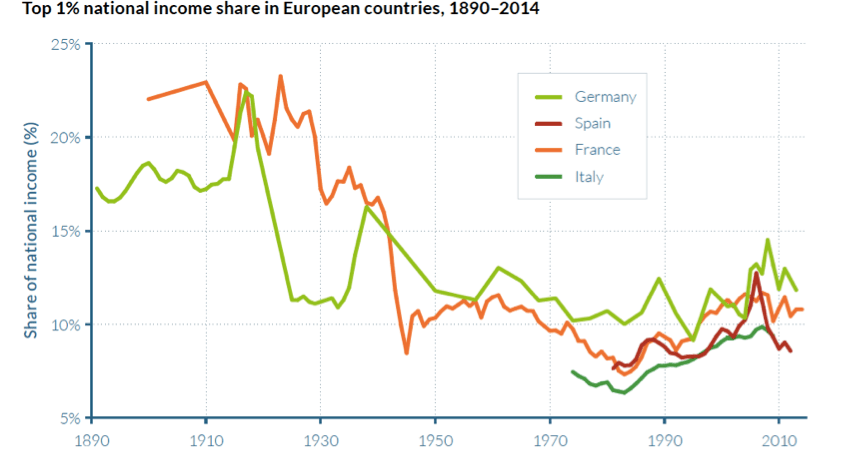

It was called the gilded age because a small minority of people – owners of capital and land – became fabulously rich. This was a time of strong economic growth, punctuated by recessions. As Picketty shows, in the late 19th century the benefits of growth were shared very unequally. Here are his estimates for the long-run top 1% income share in four European countries.

Source: World inequality data base

One unexpected benefit of this new ‘laissez faire’ international economic order was the maintenance of peace among the advanced economies. Writing at the end of World War II, Polanyi argued that, during the gilded age, a dense web of international economic obligations meant that it was in no country’s short-term interest to restrain trade by going to war. The European Union was later established with exactly this aim in mind.

In the decades leading up to World War I, the economic principles of the gilded age were turned upside down. Competition gave way to monopoly. Colonial governments used their control of money to finance wars of invasion. Labour leaders joined with industrialists to protect local industries. During that war, the Russian revolution posed a threat to the very existence of capitalism.

Attempts to restore the ‘gold standard’ and harsh reparations against Germany after the war contributed to the Great Depression of the late 20s and early 1930s. Under enormous political pressure to intervene to restore growth and employment, western governments set off on a different road between economic liberalism and socialism: keynesianism.

Keynes, a British economist, criticised the reintroduction of the gold standard in the UK during the 1920s, which constricted the supply of money and credit, reduced demand for goods and services, pressured businesses to cut wages to remain profitable, and was associated with public spending cuts. In the gilded age, this use of a ‘credit squeeze’ to restore the value of money (curb inflation) worked by shifting the adjustment to workers (cutting living standards). The main beneficiaries of ‘sound money’ were bond-holders and banks, because inflation reduced the value of debts. Their advocacy of austerity policies contributed to mounting public distrust of banks (some things remain the same!).

‘The proper object of dear money is to check an incipient boom. Woe to those whose faith leads them to use it to aggravate a depression.’ Keynes J M (1925), The economic consequences of Mr Churchill, p257.

A similar adjustment was imposed, by a different mechanism, on Australian workers and pensioners in 1933 when British bold-holders (to which state governments were heavily indebted) forced the Scullin Labor government to impose a ‘Premiers Plan’ which cut government spending, age pensions, and minimum wages.

Unemployed workers go bush, Australia (1930s)

Enter a caption

Keynes recognised that these austerity policies were socially destructive. He also argued it was self-defeating because unionised workers were for the first time in a strong enough position to oppose real wage cuts (or to quickly recapture lost wages). Further, pay cuts and public spending cuts suppressed demand for goods and services. A down-turn engineered to curb inflation and improve the efficiency of production (by cutting wages and sending inefficient producers to the wall) could trigger a deflationary spiral and plunge the economy into a depression.

In response to the depression of the 1930’s Keynes’ alternative prescription was gradually and unevenly adopted, for example in Roosevelt’s ‘New Deal’ in the US and Hitler’s investment in public and military infrastructure (though he was no follower of Keynes). The Keynesian model spread more widely after World War II, when the ‘Marshall Plan’ was adopted to rebuild Europe and national economies were still under a greater-than-usual State control (from ‘manpower planning’ to price controls and the expansion of government via income taxes) due to war requirements.

Keynes was a progressive liberal, akin to Australia’s H.B. Higgins who developed our industrial conciliation and arbitration system. Unlike the socialists, he did not advocate a transfer of power from capital to workers. Investment decisions and management of businesses were left in the hands of capitalists. Instead, he argued for government ‘management’ of overall demand for goods and services at the ‘macro’ level of national economies. The pace of growth and inflation would be regulated by a combination of fiscal policy (debt-financed expansion of the public sector in recessions and tightening of policy in booms) and monetary policy (the regulation of finance, and tightening or easing of interest rates, by central banks).

A degree of public control over the financial sector was essential to the Keynesian project, and not surprisingly this was strongly contested. To stabilise trade and capital flows, a new international financial infrastructure was laid down in Bretton Woods in 1944. This imposed fixed exchange rates among the major countries to prevent a cycle of competitive devaluations to boost national exports (by making them cheaper in other currencies). The US dollar became the reserve currency, and its value in turn was anchored in the American government’s gold stocks.

Two new institutions, the IMF and World Bank, were established as lenders of last resort for countries that were unable to grow within the constraints of their US dollar-exchange rate (for example, due to above-average inflation). This came at a price, with governments borrowing from them often required to pursue austerity policies.

The Bretton Woods system allowed countries to exert a degree of control over inward and outward capital flows, along with domestic interest rates, creating space for national governments to ‘manage’ their economies. In contrast to its freedom of movement in the gilded age, capital was now partially trapped in the ‘gilded cage’ of the national economy, though at national level it retained considerable freedom. Capital controls, industrial legislation and voting rights for workers meant that, more so than in the past, capitalists had to share their returns with workers via rising wages, and with the wider population via an expanding welfare state. As the public sector share of GDP increased, the language of economics shifted from ‘free markets’ to ‘economic management’ and from ‘laissez faire’ to the ‘mixed’ (public and private) economy.

From gilded age to gilded cage

While his economic theory was still based on the idea of free exchange among utility-maximising individuals, Keynes’ rejected the assumption that unregulated markets would, of themselves, produce the best outcomes. He argued that markets in the real world were inherently imperfect or ‘sticky’. They may reach equilibrium in the long run, but pointed out that ‘in the long run we are all dead’.

‘Very few of us realise with conviction the intensely unusual, unstable, complicated, unreliable, temporary nature of the economic organisation by which Western Europe has lived for the past half century’. Keynes J M (1919), Economic consequences of the peace, p3.

The post war compromise between capital and labour

The new order that emerged in the West after World War II owed much to Keynes, but there was also an essential political ingredient: the growing strength of the labour movement as it asserted itself in industry (aided by ‘full employment’, unionisation and progressive labour legislation), politics (through universal adult franchise and social democratic parties), and society (through the establishment of ‘welfare states’ comprising widely-available social security, health and education services). We return to the contest of political ideologies in the next part of this blog.

Full employment, wage increases, the growth of the welfare state, and its financing via progressive income taxes introduced to fund the war effort, led to a dramatic reduction in income inequality over the first 30 years following World War II. Crucially, unemployment remained below 5% in most western economies (and under 2% for the most part in Australia).

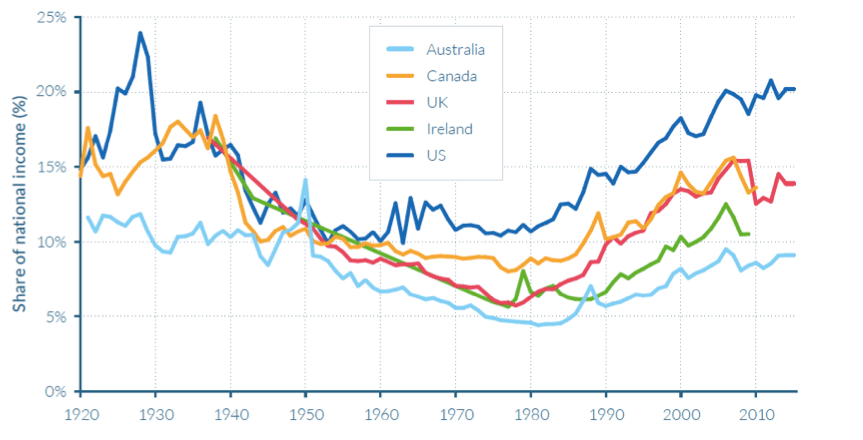

Top 1% income shares in the Anglosphere

Source: Alvaredo F et al, World Inequality report, 2018

Hayek’s road to serfdom and obscurity

For the first half of the 20th century, neoclassical economics was caught between the interventionism of the labour movement and the nationalism of the Right. Protectionism, minimum wages and the welfare state all tore at the fabric of the liberal economic and political order.

It was left to the most ideologically-committed neoclassical economists to take up the cudgels for a ‘pure’ version of the original vision. This was the Austrian school, whose protagonists witnessed the fall of the economically liberal Austro-Hungarian empire in the First World War, and the nazi invasion in the Second. Its leader, Friedrich Hayek, fought for liberalism and against socialism and conservatism. (In the next part, of this blog, we discuss the ideas of another Austrian of that era who drew different conclusions).

In 1944, he wrote ‘The Road to Serfdom‘ to warn the British of the dangers of totalitarian rule, which he associated with socialism and nazism. Hayek argued that that only a free market can effectively process information on the diverse and complex needs and resources of individuals, to achieve the best outcomes for all.

The cartoon version of Hayek’s Road to Serfdom was published by General Motors in 1944, as parts of its campaign against extension of wartime planning powers.

Hayek fought for minimal State intervention in markets. For him, socialism risked dictatorship, the welfare state undermined individual freedom and the efficient operation of markets, and conservatives were dangerously prone to nationalism.

As the Jesuits fought to revive Roman Catholic theology during the counter-reformation, the Austrian school fought to revive neoliberal ideas as they faced their greatest threat. In the Keynesian era, this relegated it to the fringes of economics and public policy, where it remained for over two decades.

From Austria to Chicago, and back into the mainstream

After the war, along with Milton Friedman and Karl Popper, Hayek formed the Mont Pelerin Society so that supporters of neoliberalism could meet every two years and share and propagate their ideas.

Those ideas, which they carried from the ‘Austrian school’ to the ‘Chicago school’, had little impact at the time, but as Stedman Jones chronicled, were very influential thirty years later. Eight prominent members won Nobel Prizes in Economics from the 1970s to 2000. Friedman’s Presidential address at the American Economic Association in 1967 marked a ‘turning point in the history of macroeconomic research’.

Many economists would argue that the academic study of economics at this time (and since) was much more diverse than a narrow set ideas based on neoliberal ideology, or adherence to neoclassical theories. New approaches, from behavioural economics to game theory, were challenging the notion that markets were the product of interaction among rational, utility-optimising individuals (though these were still blind to the institutional settings in which individuals interact).

Intellectual prowess wasn’t the main source of neoliberal influence at this time. The Nobel Prize in Economics provides a clue. From 1968, this new prize was funded and promoted by the Swedish Riksbank, which was chafing under the social democratic orthodoxy of its home country.

In the 1970s, neoliberal thinking came to dominate economic policy in the Anglosphere, and international institutions including the IMF, World Bank and the OECD. A key reason for this was that the impact of economic ideas is mediated by politics, which in turn is driven by ideology and the clash of vested interests. Behavioural economics and game theory are now having an impact at the margins of policy (as seen from the proliferation of ‘nudge units’ in government departments), but nothing on the scale of the shift in economic policy in the 80s and 90s towards ‘free market’ solutions.

It was neoliberalism’s link to a new ideological movement nurtured by business-funded think tanks such as the Heritage Foundation and the Centre for Policy Studies and championed by Reagan and Thatcher, that brought neoliberalism into the slipstream of political influence.

‘MT’s first encounter with Hayek came when he published The Road to Serfdom in 1944. She read it as an undergraduate at Oxford, where it became part of her enduring outlook. In fact one can argue that few books influenced her more deeply at any point in her life.’ (Margaret Thatcher archives)

The keynesian system unwinds

Still, clever ideas and good political connections weren’t enough to overturn decades of economic orthodoxy. Neoliberals had to show that their theories could solve real problems that Keynesianism could not. That opportunity came in the 1970s.

The Keynesian system was undermined by three factors. First, multi-national companies and international financial institutions managed to circumvent the Bretton Woods exchange controls (with the aid of the City of London) and even ‘bet’ against changes in the value of national currencies. Second, to finance the Vietnam war, the Nixon administration abandoned the link between the US dollar and gold in the 1970s, which (along with a spike in the price of oil) triggered a worldwide spike in inflation.

Third, and crucially, higher inflation was accompanied by higher unemployment. This reflected weak growth in productivity across the western world, a sign that the post-war model of mass production behind tariff walls was faltering. Keynesian macroeconomic management had no answer at the time for the unexpected and toxic combination of high inflation and high unemployment. When governments tried to stimulate the economy by running budget deficits, unemployment remained high and inflation crept higher, reaching over 15% in Australia in the mid 70s. This, as much as any other single factor, led to the downfall of the Whitlam government in 1975. The Fraser government did not have the answers either: it presided over a deeper recession in the early 1980s.

Immediately after that recession, inflation and unemployment both exceeded 10%. Some economists combined the two measures into a ‘misery index’ which remained stubbornly high throughout the 1980s.

The neoliberal ascendency

Friedman and the Chicago school promoted an alternative to the Keynesian model which they argued had failed. This had three parts: tighter monetary policy (restraining credit) to bring inflation down, the loosening of government controls over investment and labour markets to improve the efficiency of the economy at the micro level (lifting productivity), and ‘smaller government’ to make way for private investment.

Broadly speaking, neoliberals argued that the causes of faltering economic growth lay on the ‘supply side’ of the economy, and that once these pro-market policies cleared its arteries, growth would reach the happy equilibrium predicted by neoclassical economists a century before.

Hayek meets Reagan

The arguments between neoclassical and keynesian economics resumed, with the Chicago boys in the ascendency. Here’s the rap version: Keynes Vs Hayek rap

At first, the Chicago school advanced ‘monetarism’ (the idea that inflation was best controlled by setting targets for the volume of money circulating in national economies) as their main alternative to keynesianism. When monetary targeting proved impractical, ‘inflation targeting’ came to dominate monetary policy while full employment (as understood in the 1950s and 60s) was relegated to the back seat.

By the 1980s other elements of the Chicago agenda – such as ‘smaller government’, financial de-regulation, removal of barriers to trade, and a shift towards workplace wage bargaining – were advocated (though not always put into practice) by governments of both liberal and social democratic persuasion (as we saw in Australia in Part 3 of this blog). The spread of these pro-market policies was uneven. They were pursued first, and most comprehensively, by the Anglophone countries, while most of continental Europe and Japan championed different models of economic development.

The industrial powerhouses of Germany and Japan favoured corporatism, in which governments, big business and unions collaborated to grow and modernise manufacturing industries and finance served industry rather than the other way round. The Nordic countries combined these elements with greater openness to trade, a stronger commitment to equality, and a generous welfare state. Firmly esconced in the Anglosphere, Australia remained largely oblivious as a ‘war of the models’ raged, with no clear winner. The Americans claimed greater success than ‘Europe’ in reducing unemployment and boosting productivity, yet Sweden, West Germany and Austria achieved similar results with less inequality, and Japanese companies were taking over less-efficient American car-makers.

With the demise of the Soviet Union and its East European satellites in the early 90s, the US (and Margaret Thatcher) declared victory on the grounds that the Anglophone model was the polar opposite of the failed communist one. A decade of solid growth in employment and productivity in the US, and the adoption of elements of the neoliberal model by post-communist Russia (including flat income taxes, the rapid dismantling of centralised planning, and perilously weak regulation of the oligopolies that replaced it), seemed to confirm this.

After keeping unemployment below 5% right up until the early 1990s recession, the Swedish model faltered as unemployment doubled and big business agitated for pro-market reforms.

This was the moment that social democratic parties came to terms with neoliberalism. Clinton, Blair and Schroder declared a ‘third way’ or ‘new middle’ that combined deregulation of the old protective institutions (such as tariffs and centralised wage fixing) with introduction of new ones (such as in-work benefits for low-paid workers). As we saw in Part 3, Australia under the Hawke governments had already moved in this direction in the 1980s, so neoliberal policies also peaked earlier here with the ‘Fightback’ election of the early 1990s.

By the 1990s, the cutting edge of ‘economic reform’ was associated in the minds of policy-makers across the West with reduced public regulation of markets, even though continental Europe and Japan retained corporatist institutions that mostly kept neoliberal policies at bay, and the overall size of the welfare state was not reduced by austerity policies (including in the Anglophone countries).

The entry of China to the World Trade Organisation in 2001, and its rapid growth underpinned by trade and absorbtion of western technology, yet again seemed to confirm the demise of central planning and close regulation of markets – though in reality China pursued its own model.

The screw turns again

After the great recession of 2009, the screw turned once again and neoliberalism was on the defensive. The recession (called the ‘Global Financial Crisis’ or GFC in Australia) shattered faith in the liberalisation of markets, especially financial markets. It ushered in a new set of economic challenges badged ‘secular stagnation’: unlike the 70s and 80s policy makers now had to contend with sluggish growth in incomes and consumption combined with low inflation. Western economies seemed to be locked into a miserable equilibrium of low growth in wages and less secure employment (despite falling unemployment), ballooning debt and asset prices, and under-investment.

A decade after the GFC, neoliberalism is now challenged ‘from within’ by leading international economic institutions that were once its cheerleaders, including the IMF and OECD, as well as many prominent economists (such as former Governor of the British central bank, Mervyn King.

The free market or ‘neoliberal’ model developed by economists such as Milton Friedman and Friedrich Hayek appeared to offer a better economic analysis, and a more dynamic policy prescription. Adopted originally (and most fully) by the US and UK under the governments of Ronald Reagan and Margaret Thatcher, the market-oriented model in various forms came to be applied widely across the OECD in the subsequent decades.

Social scientists describe these moments of economic change as ‘paradigm shifts’ – periods when old orthodoxies are unable either to explain or to provide policy solutions to conditions of crisis, and new approaches take their place. More than a decade after the financial crash, with the global economy and many individual OECD countries facing multiple crises, our argument is that the time is ripe for another such paradigm shift. OECD (2019), Beyond growth, p20.

These organisations have found that markets don’t stabilise themselves after all, and that – as in the 70s and 80s – new economic challenges call for new thinking.

Keynes was famously said to have quipped: ‘when the facts change, I change my mind: what do you do, sir?’. Well, maybe he didn’t say it, but it’s a nice phrase.

Neoliberalism has also been challenged ‘from without’ by successive waves of popular protest against free trade, mass migration, and the dominance of ‘elites’ (especially the financial sector and corporate lobbyists) in economic policy-making.

The ‘great recession’ and its aftermath has ushered in a period of political instability vaguely badged as ‘populism’, as the neoliberal centre loses its hold over national politics and more radical visions crowd out the once dominant view that: ‘reform = more market’.

We saw in Part 3 of this blog how Australian political leaders and officials retreated from neoliberalism after John Hewson’s election loss in 1992, and again after the GFC.

I’ll leave the last words to Prof. Robert Skidelsky at Warwick University: Study history, it doesn’t repeat but it rhymes!

Conclusions

Neoliberalism is the ideology underpinning neoclassical economics. Both were the offspring of liberal philosophy in the 18th and 19th centuries, and the birth of capitalism. In its neoclassical turn in the late 19th century, economics narrowed its gaze from classical political economy’s study of the origins of value and the relationship between markets and civil society, to the operation of markets as transactions among utility-maximising individuals. This made way for the development of ‘economic models’ to predict outcomes mathematically, which the neoclassicists believed would elevate economics to the status of a science on a par with physics and chemistry.

Given its philosophical roots in liberalism, and a blinkered view of how societies function, neoclassical economics had an inbuilt bias towards expanding the domain of private markets (including internationally via the medium of ‘sound money’). During the ‘gilded age’ of capitalism in the late 19th century, these ideas achieved great influence, especially in the Anglophone countries. As the industrial revolution and rapid expansion of trade lifted living standards (for the middle classes if not production workers), the removal of restrictions on trade, the supply of labour, and especially finance, seemed like the magic elixir for growth.

In the first half of the 20th century, this ‘laissez faire’ (leave-alone) approach came under pressure as the benefits of growth were concentrated in fewer hands, even while the vote was extended to all adults. National governments shielded their own industries and workers against the winds of competition in the face of two world wars and the great depression. Capitalism itself was challenged by socialist alternatives.

Neoclassical economics gave way to Keynesianism, with its more regulatory approach to trade and capital flows, and ‘demand management’ to sustain growth and living standards. Together with the growing influence of social democratic parties, unionisation, and the development of welfare states and progressive taxation, this greatly reduced income inequality from the end of World War II up to the 1970s.

Neoliberal ideology was sustained during this period by economists from the Austrian and later Chicago schools, who led a revival of neoclassical economics when Keynesianism stumbled in the face of the ‘stagflation’ of the 1970s. Though economic thought was actually much more diverse by this stage, by the 1980s and 90s the neoclassical revivalists (such as Milton Friedman) gained real influence in the major Anglophone countries through their connections with corporate-funded think-tanks and the Thatcher and Reagan governments.

After the fall of the Soviet Union in the early 1990s, neoliberal policies secured stronger footholds in European counties and political parties that previously held out against them, including social democrats. Nevertheless, ‘western’ economic systems, with their diverse histories, political dynamics and institutions did not converge towards a ‘free market’ model. ‘Corporatism’ remained in place in continental Europe and Japan, long after its abandonment by Australia (See Part 3).

In the 2010s, the screw turned again. Neoliberalism seemed to have no answer for the near-collapse of global financial markets, and banks as well as citizens once again turned to governments for salvation. Resentments against extreme inequality and economic insecurity that had bubbled away during the period of neoliberal ascendancy were now vented – starting in the countries where it all began: the United States and Britain (Part 2 of this Blog).

Where to next?

Since the industrial revolution, the history of capitalism has been marked by the rise and decline of neoliberal ideas, as markets extended their reach within nations and beyond them, and were then brought to heel. Market liberalisation was supported by those with the political power to sustain it, as long as living standards and economic opportunities expanded.

That support was withdrawn, or fatally challenged from below, as evidence of the destructive consequences of weakly-regulated capitalism accumulated – including excessive concentrations of economic power, income and wealth inequality, the plunder of the ‘commons’ (the public institutions that provide benefits, services, and social solidarity which markets cannot – especially the catastrophic impact of unbalanced economic development on the natural environment), and the economic and social insecurity felt by a large share of the population.

To understand what drove these long cycles of economic policy, we need to venture beyond economics – especially its neoclassical variants which are ahistorical because they have no concept of society. We need to follow the example of the best of the early political economists who combined the study of politics, society, and economy before the schism between political science, sociology and economics opened up.

One such attempt is the work of Acemoglu and Robinson, assembled in their extraordinary book, ‘Why Nations Fail’. They lift their gaze from individuals competing in markets to the institutions that frame how markets have functioned both through the ages and across continents. They divide these institutions (which have national political systems, or the lack of them, at their centre) into two types: extractive (where wealth and power flow to the top) and inclusive (where both are more widely shared) and argue that only inclusive institutions allow sustained growth in living standards and political stability.

Acemoglu and Robinson offer convincing evidence for their thesis through dozens of national case studies, but jumping as it does between ancient Rome, European capitalism and pre-colonial African kingdoms, it loses the thread of history. It’s not clear why extractive institutions give way to inclusive ones and vice versa, through history on an international scale, as distinct from individual nations.

And two categories of political, social and economic system are not quite enough, even if we only compare western capitalist nations. We probably need three to complete the picture.

In the next instalment of this blog, we bring political science and sociology to bear to better understand the ebbs and flows of market liberalisation and its accompanying ideology – neoliberalism – and why the ‘neoliberal centre’ is unravelling now.

[Special thanks to Prof Frank Stilwell, who reviewed an early draft. Errors all mine.]

Further reading

Acemoglu & Robinson (2018), Why nations fail. Profile Books, London.

Boerger L (2016), Neoclassical economics, Exploring Economics.

Colander D (2000), The death of neoliberal economics, Journal of the history of economic thought, Vol 22 No 2.

DeWiel B (1997), A Conceptual History of Civil Society: From Greek Beginnings

to the End of Marx, Past Imperfect. Vol. 6, 1997, pp.3-42.

Dolvik J et al (2014), The Nordic model, FAFO Institute, Oslo

Freeman R (1997), War of the models. Labour Economics Vol 5, pp 1–24.

Giddens A (2003), Capitalism and Modern social theory, an Analysis of the Writings of Marx, Durkheim and Weber. Cambridge: Cambridge University Press.

Hall P (1989), The Political Power of Economic Ideas: Keynesianism across Nations, Princeton University Press.

Hall P & Soskice D (2001), Introduction to varieties of capitalism, Semanticscholar online.

Meidner R (1993), Why did the Swedish model fail?. Socialist Register, 1993.

OECD (2015), Opportunities for All

OECD (2019), Beyond growth, towards a new economic approach,

Report of the Secretary General’s Advisory Group on a New Growth Narrative.

Ostry J et al (2016), Neoliberalism oversold?, Finance & Development, June 2016.

Pierson P (2011), The welfare state over the very long run, Working Paper 02/2011, Zentrum für Sozialpolitik, University of Bremen.

Skidelsky R (2018), Is history important? Institute for New Economic Thinking.

Standing G (2018), The plunder of the commons, Penguin.

Stedman-Jones D (2012), Masters of the universe, Princeton University Press.

Sweet W, Jeremy Bentham, Internet encyclopedia of philosophy.

Viera, O The Neoclassicals’ Conundrum: If Adam Smith Is the Father of Economics, it is a Bastard Child. Working Paper No. 893, New York: Levy Economics Institute.